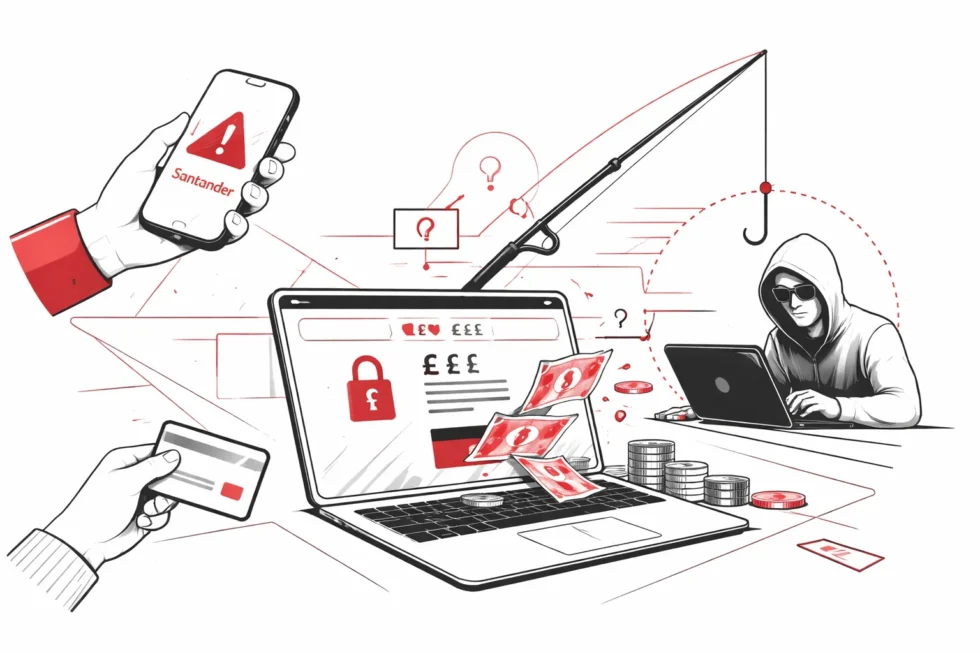

Monday, 26 January 2026 — Santander has issued a new warning to UK banking customers after identifying a rise in task-based online scams targeting people seeking additional income ahead of January payday.

According to data released by the bank, more than £95,000 was stolen from customers between October and December 2025 through scams offering payment for completing simple online tasks. Santander said the fraud activity intensified in the weeks following Christmas, when household finances are typically under increased pressure. Reports The WP Times, citing an official Santander UK fraud warning published via the bank’s Media Centre.

The bank said scammers are promoting so-called “side hustles” that promise easy earnings for activities such as liking, sharing or interacting with social media content. In many cases, victims receive small initial payments before being asked to transfer larger sums or pay upfront fees, after which contact ceases.

Santander’s analysis shows that almost £31,000 of the total losses recorded in the final quarter of 2025 were linked to schemes involving social media platforms, including TikTok. Customers aged between 20 and 55 were most commonly affected, according to the bank. The bank said criminals frequently use the names of well-known companies to gain credibility. Legitimate brands cited in scam approaches included Allianz, Starfish and Indeed, Santander confirmed.

“January payday still feels a long way off for many, as the costs of Christmas start to roll in,” said Chris Ainsley, Head of Fraud Strategy at Santander UK (Santander UK statement, January 2026, London). “Looking for ways to make some extra cash provides scammers with an opportunity to pounce.”

He added: “Be wary of any jobs that seem too good to be true, promising returns for simply ‘liking’ social media content. Any requests to pay an upfront fee to take on a job should be treated as a scam” (Santander UK statement, January 2026).

Santander said fraudsters often move conversations away from public platforms to private messaging apps, reducing transparency and limiting the ability to verify the legitimacy of offers.

Separate retail and ecommerce data also point to January as a high-risk period. “January is a perfect storm for scams like these,” said Marty Bauer, Retail and Ecommerce Expert at Omnisend (Omnisend commentary, January 2026, UK). “After Christmas, when payday feels far away, people are more open to online opportunities, and this is when scammers strike.”

Bauer said genuine income streams typically involve established marketplaces and realistic earning expectations, rather than guaranteed or instant returns (Omnisend commentary, January 2026). Santander advised customers to avoid sending money or personal details to unverified contacts, to treat unsolicited job offers with caution, and to report suspected scams through official banking channels. The bank said early reporting helps limit further losses and supports wider fraud prevention efforts.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Gold price UK and gold price today enter new market regime after $5,000 breakout