Cryptoassets in ISAs are no longer a distant dream but a looming reality in the UK’s financial system. In a move that could fundamentally reshape how millions of Britons save and invest, HMRC has confirmed that crypto exchange-traded notes (cETNs) may soon qualify for inclusion in Individual Savings Accounts (ISAs) — the country’s flagship tax-advantaged savings vehicles. This decision, in coordination with the Financial Conduct Authority (FCA), marks the first major step toward integrating regulated crypto exposure into the British tax-sheltered investment landscape.

The implications are sweeping. For years, investors holding Bitcoin or Ethereum outside regulated platforms faced volatile markets, uncertain tax reporting, and the looming specter of capital gains tax (CGT). The new ruling could exempt crypto-linked returns from taxation, potentially transforming portfolio strategy for households and wealth managers alike. It also signals London’s determination to stay relevant as a post-Brexit financial innovation hub. Yet beneath the excitement lie questions about regulatory clarity, investor protection, and who will truly benefit from this “crypto-ISA revolution.” As noted by The WP Times, this move may set a precedent for the entire European market, blending fintech progress with fiscal pragmatism.

How HMRC and the FCA Are Opening the Door to Crypto ETNs

After years of cautious distance, the FCA has announced that starting 8 October 2025, retail investors will gain access to crypto exchange-traded notes (cETNs) listed on recognised investment exchanges. These securities track the price of cryptocurrencies such as Bitcoin, Ethereum, Solana, and XRP, but do so through regulated issuers and custodians.

At the same time, HMRC published detailed tax guidance confirming that cETNs will be eligible for ISA inclusion, making any gains realised inside those wrappers exempt from capital gains tax. The measure initially applies to Stocks & Shares ISAs, but from 6 April 2026, crypto ETNs will migrate to Innovative Finance ISAs (IFISAs) — a structure typically used for peer-to-peer loans and higher-risk assets.

The FCA’s decision overturns the 2020 retail ban on crypto ETNs, a ban that was originally justified by investor-protection concerns following several exchange collapses. “The crypto market is maturing,” said Sarah Pritchard, FCA’s Executive Director of Markets. “With proper safeguards, investors can access regulated exposure within a transparent framework.”

For HMRC, the motivation is equally clear: transparency and tax compliance. The department aims to bring digital-asset profits into the visible economy, replacing opaque offshore trades with traceable, regulated instruments.

Dual-phase rollout: risk control and investor confidence

The two-stage introduction — Stocks & Shares ISAs first, then IFISAs — allows regulators to test demand without overexposing retail investors. In the early phase, established brokers such as Hargreaves Lansdown, AJ Bell, and Interactive Investor may pilot cETN offerings.

This gradual approach mirrors the UK’s long-term strategy: attract innovation while retaining control. It positions Britain somewhere between the U.S. “crypto-ETF boom” and the EU’s cautious MiCA framework, offering a distinct middle path that balances access with oversight.

What It Means for British Investors

The average UK investor has £20,000 per year in ISA allowance — a sum that can now include exposure to digital assets for the first time. For many, this is a historic opportunity: tax-free participation in the cryptocurrency market.

Yet, investors should understand that ETNs are not direct crypto holdings. They are debt securities issued by financial institutions such as WisdomTree, 21Shares, or CoinShares, which promise returns based on crypto prices. Unlike exchange-traded funds (ETFs), ETNs carry issuer credit risk — if the issuer defaults, investors may lose their capital.

Key investment impacts:

- Diversification: Crypto ETNs allow balanced exposure without needing direct custody of digital wallets.

- Tax simplicity: Gains inside ISAs are exempt from CGT reporting, easing administrative burdens.

- Volatility management: ETNs offer tracking but not leverage; still, crypto’s underlying volatility persists.

- Institutional credibility: The FCA’s involvement boosts trust after years of unregulated market chaos.

During the 2025–2026 transitional window, investors can hold cETNs in Stocks & Shares ISAs — securing indefinite CGT protection even after the shift to IFISA. For some, this could represent the most tax-efficient crypto exposure globally.

“This move could channel billions into regulated crypto,” notes MoneyWeek analyst Darius McDermott. “Even if a fraction of ISA capital shifts, it’s a signal that crypto is no longer fringe finance.”

Market Size and Potential Capital Inflows

The ISA market currently holds over £830 billion in assets. According to data from ETF Express, around £400 billion sits in Stocks & Shares ISAs, and another £600 billion in pensions. If even 1% of ISA capital reallocates to crypto ETNs, the inflow would reach £8–10 billion in the first two years — enough to significantly deepen liquidity for UK-listed digital-asset products.

| Indicator | Current Estimate (2025) | Source |

|---|---|---|

| Total ISA AUM | £830 bn | HMRC |

| Stocks & Shares ISA AUM | £400 bn | HMRC |

| Potential Crypto Allocation (1%) | £8–10 bn | MoneyWeek |

| Crypto Market Cap (Global) | $2.5 tn | CoinMarketCap |

| FCA-approved ETN issuers | 3–5 expected | FCA |

However, adoption will hinge on platform integration and regulatory stability. Some retail brokers remain hesitant, fearing reputational risk and the technical burden of crypto compliance.

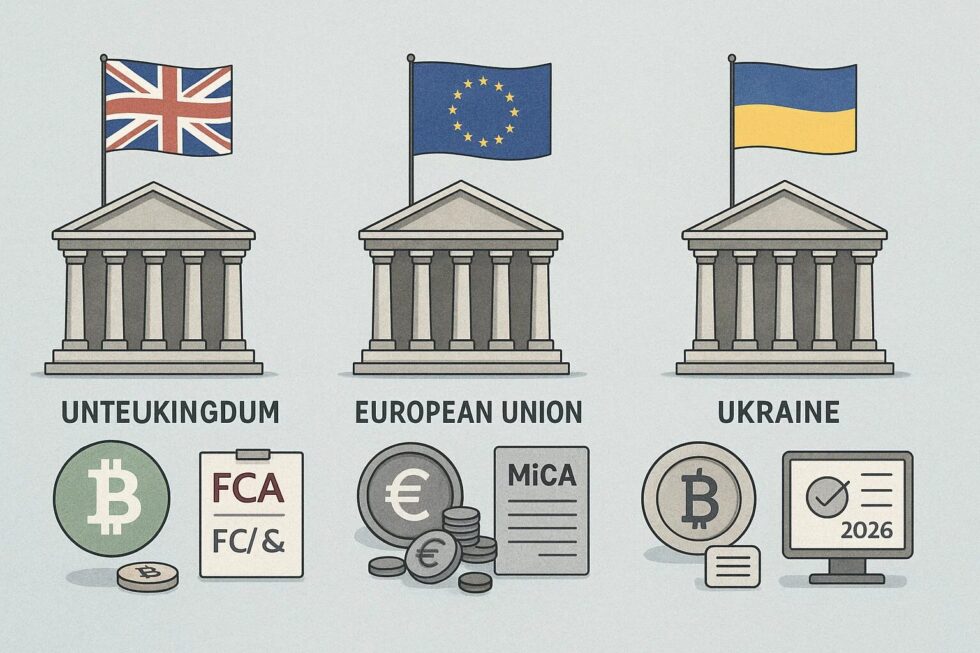

Comparing the UK, EU and Ukraine: Three Paths to Crypto Taxation

The UK’s approach — embedding crypto into tax-advantaged structures — stands in contrast to most European systems.

United Kingdom

- Tax treatment: cETNs in ISA are fully CGT-exempt.

- Regulator: FCA & HMRC cooperation.

- Goal: Channel investment into regulated markets; increase transparency.

European Union

Under the EU’s Markets in Crypto-Assets Regulation (MiCA), crypto-related financial products are subject to national taxation with no harmonised relief.

- Germany: Tax-free after holding crypto for one year.

- France: Flat 30% capital gains.

- Poland: 19% CGT; no tax-free wrappers.

- Spain: Up to 26% tax on gains.

Ukraine

Ukraine’s evolving crypto policy — aligned with the EU’s digital-finance roadmap — defines crypto as a virtual asset under taxation law.

- Tax: Treated as income or capital gain depending on activity type.

- Reporting: Mandatory exchange disclosures from 2026.

- No ISA equivalent, meaning investors cannot shield profits from tax.

| Region | Tax Relief for Crypto | Regulatory Framework | Market Maturity |

|---|---|---|---|

| UK | Full CGT exemption in ISA | FCA + HMRC | High |

| EU | Varies (0–30%) | MiCA (2024-26 rollout) | Medium |

| Ukraine | None | Under development | Low |

The UK’s policy is thus exceptionally generous. It effectively treats crypto like equities and bonds, granting long-term investors a tax-neutral environment.

Political and Economic Context

Behind the policy lies a strategic calculation. Post-Brexit Britain has sought to maintain relevance as Europe’s financial-services leader. With competition from Frankfurt, Paris, and Dublin intensifying, digital-asset regulation offers a new frontier.

In 2023, Chancellor Jeremy Hunt declared a plan to make the UK a “global crypto-asset hub.” The 2025 ETN reform fulfills that promise, aligning the Treasury’s innovation agenda with HMRC’s fiscal pragmatism.

This alignment is not just economic but geopolitical. By establishing itself as the first major European market to integrate crypto into mainstream tax shelters, the UK sends a message to investors and fintechs alike: Britain is open for digital finance.

However, critics warn of over-optimism. “Tax incentives do not erase volatility,” says Katherine McGuire of ETF Express. “Retail investors could mistake regulatory approval for safety, which is not guaranteed.”

Risks, Safeguards, and Investor Responsibility

While cETNs are regulated instruments, they are not risk-free. The FCA’s framework imposes strict disclosure and suitability requirements, but investors must still understand what they own.

Main risk categories include:

- Market risk: Crypto prices remain volatile — Bitcoin has moved ±40% within single months.

- Issuer credit risk: ETNs are unsecured; issuer default means potential total loss.

- Liquidity risk: Early-stage UK cETNs may face low trading volumes and wide spreads.

- Regulatory risk: Future changes (e.g. exclusion from ISAs) could alter tax treatment.

- Custody risk: If underlying crypto is poorly secured, ETN value could drop regardless of price.

| Risk Type | Description | Mitigation |

|---|---|---|

| Market | Price volatility of underlying crypto | Limit allocation, diversify |

| Credit | Issuer insolvency | Choose reputable issuers |

| Liquidity | Low trade volume | Use major exchanges |

| Regulatory | Policy changes | Follow FCA/HMRC updates |

| Custody | Security breaches | Prefer insured custodians |

Investors should treat crypto ETNs as satellite holdings, ideally no more than 5–10% of an ISA portfolio, complementing core equities and bonds.

Steps UK Investors Can Take Right Now

Before the October 2025 launch, retail savers can begin preparing:

- Check platform readiness: Confirm if your ISA provider (e.g. IG, AJ Bell) plans to support cETNs.

- Understand costs: Review issuer fees, bid-ask spreads, and management expenses (often 0.95–1.5%).

- Assess risk tolerance: Crypto volatility may not fit conservative retirement planning.

- Watch policy updates: HMRC guidance and FCA press releases often contain transitional clauses.

- Diversify geographically: Combine UK crypto ETNs with EU or US ETFs for broader exposure.

- Document all trades: Even inside ISAs, maintain transaction records for compliance.

“Knowledge and patience will define winners in this new market,” says Chris Ayers, head of digital strategy at Saxo Bank UK. “Crypto ETNs offer access, not a guarantee of profit.”

Broader Implications: Britain’s Bet on Regulated Crypto

The inclusion of crypto ETNs in ISAs marks more than a tax reform — it’s a philosophical shift. The British government, traditionally conservative in financial regulation, is effectively betting that bringing crypto inside the system is safer than leaving it outside.

If successful, it could transform how Europe regulates and taxes digital assets. If it fails, it risks damaging investor trust and repeating the over-financialisation mistakes of the 2000s.

Yet the direction is clear: the line between “traditional” and “digital” finance is blurring fast. For everyday savers, crypto exposure may soon be as routine as owning a FTSE 100 tracker.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: How Did Trump's 100% Tariff on China Trigger a $19B Crypto Crash