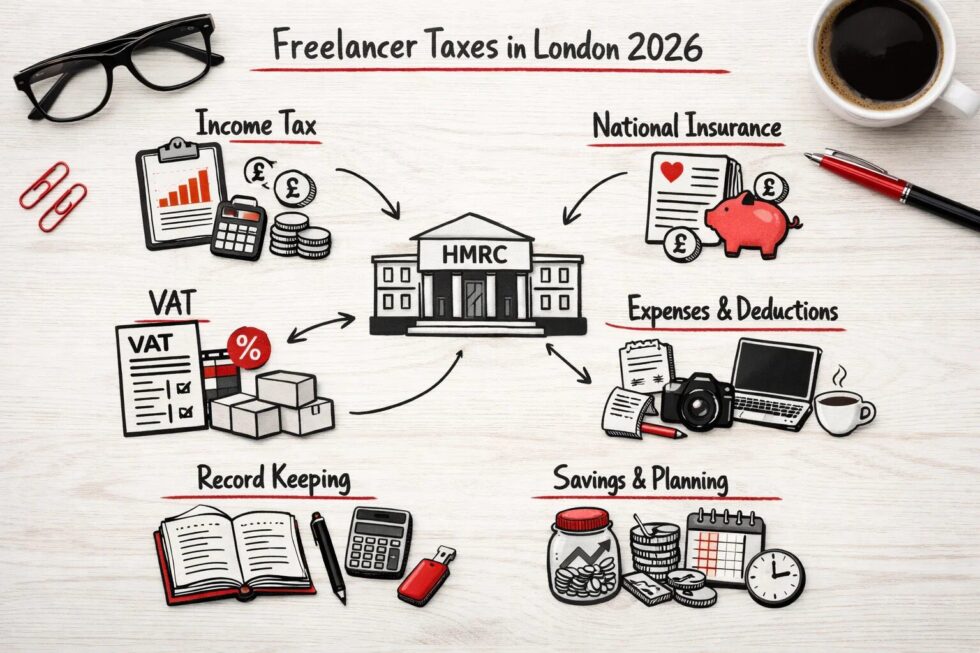

Freelancers in London face a complex tax environment in 2026, with multiple obligations to HM Revenue & Customs (HMRC). Understanding these taxes is essential for self-employed professionals, contractors, and gig economy workers who live or work in London. Taxes impact income, expenses, and long-term financial planning, making accurate knowledge crucial for compliance and efficiency.

Key taxes include income tax, National Insurance contributions (NICs), and VAT for eligible turnover thresholds. Beyond statutory requirements, freelancers must also consider allowable expenses and record-keeping practices to minimize liabilities. This guide provides a clear breakdown of what taxes freelancers in London pay, how to calculate them, and practical steps for daily management, ensuring local professionals can operate confidently. This is reported by The WP Times.

What is Freelancer Taxation and How It Works in London

Freelancer taxation in London involves reporting self-employed earnings to HMRC, paying income tax, National Insurance contributions, and, in some cases, VAT. Income tax is calculated based on profit, which is total income minus allowable business expenses. National Insurance is mandatory for all self-employed individuals earning above the Lower Profits Limit (£12,570 in 2026). VAT registration is required if annual turnover exceeds £85,000. London freelancers often face additional considerations such as local council tax and business rates for home offices or rented premises. Understanding thresholds, deadlines, and applicable allowances ensures compliance while minimizing unnecessary payments. HMRC’s online services allow easy filing, payment tracking, and record-keeping, supporting freelancers across different boroughs from Camden to Southwark. LSI keywords: self-employed taxes, UK freelance income, HMRC guidelines.

| Feature | Details | London Notes |

|---|---|---|

| Income Tax | Paid on profit after expenses | 20% basic, 40% higher, 45% additional |

| National Insurance | Class 2 & 4 contributions | Class 2 £3.45/week, Class 4 9% profits £12,571–£50,270 |

| VAT | 20% standard rate | Mandatory if turnover > £85,000/year |

| Allowable Expenses | Costs reducing taxable profit | Office rent, software, travel, equipment |

| Deadlines | Annual self-assessment | 31 Jan online filing, 31 Oct paper |

How Freelancer Taxes Work in Real Life for London Residents

Managing taxes as a freelancer in London requires systematic record-keeping and awareness of payment timelines. First, register as self-employed with HMRC within three months of starting work. Keep digital and paper copies of all invoices, receipts, and bank statements. Track profits monthly to anticipate income tax and National Insurance contributions. For freelancers exceeding £85,000 turnover, register for VAT, charge clients appropriately, and submit quarterly VAT returns. Use HMRC’s online self-assessment portal to calculate liabilities and make payments before the 31 January deadline to avoid penalties. Many London boroughs provide local support, including workshops on tax management for self-employed residents. For example, the City of London and Westminster councils offer guidance on allowable expenses and online filing tips. Consistent tracking ensures freelancers are prepared for year-end payments and can claim all entitled deductions.

Key Steps for Freelancers in London:

- Register as self-employed with HMRC

- Maintain accurate income and expense records

- Submit annual self-assessment online

- Calculate and pay Class 2 and 4 National Insurance

- Register for VAT if turnover exceeds threshold

Bullet List: Key Tax Actions for London Freelancers

- Important requirement: Timely self-assessment registration

- Key document or step: Keep invoices and receipts for all business income and expenses

- Useful local tip: Use HMRC’s Making Tax Digital portal for London-based freelancers

- Common rule: Pay taxes by 31 January to avoid interest and penalties

- Practical recommendation: Consider a separate bank account for freelance income

Real-Life Situations in London

Many freelancers face scenarios where understanding local rules is essential. For instance, a graphic designer in Hackney working with multiple clients must track income from each project to calculate accurate profits. “Many Bay Area residents face this situation every year,” explains a local consultant. Similarly, a software contractor in South Kensington providing services to international clients may exceed the VAT threshold, requiring quarterly returns. “Understanding the local rules is essential in London,” notes a community adviser. Both examples highlight the importance of accurate bookkeeping, timely registration, and adherence to deadlines to maintain compliance and optimize tax outcomes.

| Option | Benefits | Limitations |

|---|---|---|

| Self-assessment online | Easy calculation and submission | Requires digital literacy |

| Accountant services | Professional guidance, error reduction | Costly for small freelancers |

| Bookkeeping software | Efficient expense tracking | Subscription fees may apply |

| HMRC guidance | Free, authoritative | Can be complex for beginners |

Common Mistakes London Freelancers Should Avoid

Freelancers often underestimate tax liabilities or misclassify expenses. A frequent error is neglecting to register as self-employed within the three-month window, leading to late penalties. Another common issue is failing to track all income, particularly from cash or overseas clients, which can result in underreported profits. Misunderstanding VAT obligations is also widespread, with freelancers either overcharging or neglecting registration when turnover exceeds £85,000. Additionally, claiming non-allowable expenses can trigger HMRC audits. Accurate record-keeping, using HMRC’s digital tools, and consulting local support resources reduce risks. London freelancers should also be cautious about mixing personal and business finances, as this complicates profit calculations and audit preparedness.

Frequently Asked Questions

Q: What taxes do freelancers in London pay on their income?

A: Freelancers pay income tax on profits and National Insurance contributions (Class 2 and Class 4). Income above thresholds is taxed at rates from 20% to 45%.

Q: Do all freelancers in London need to register for VAT?

A: No, only those with annual turnover exceeding £85,000 must register and submit quarterly VAT returns.

Q: What expenses can London freelancers deduct from their profits?

A: Allowable expenses include office rent, software subscriptions, travel for work, and professional equipment.

Q: When are self-assessment tax returns due for freelancers?

A: Paper returns are due by 31 October; online returns must be submitted by 31 January following the tax year.

Q: How much National Insurance do freelancers in London pay?

A: Class 2 contributions are £3.45/week; Class 4 contributions are 9% on profits between £12,571 and £50,270, with 2% above that.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Why did UK health insurance claims hit a record £4bn in 2024 as workplace cover surged