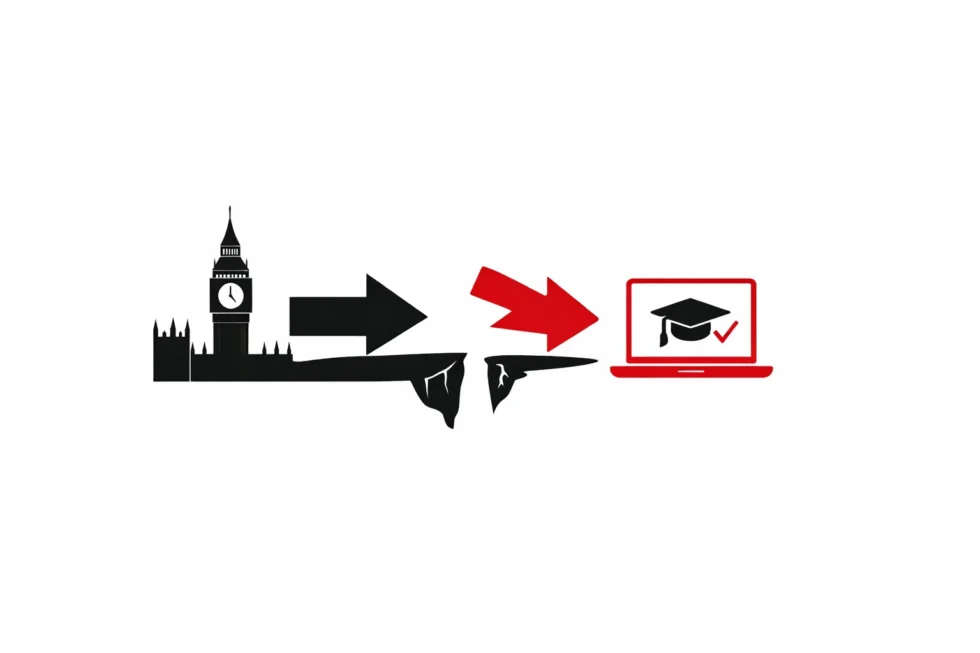

ACCA exams are being fundamentally restructured after Britain’s largest accounting body confirmed that from March 2026 most candidates will no longer be allowed to sit exams remotely, following what regulators describe as a sharp rise in AI-driven exam fraud. The move will affect more than half a million students worldwide, including tens of thousands in the UK, and will change how accountants, auditors and finance professionals qualify in Britain. As reports The WP Times, citing The Guardian, the decision reflects growing evidence that artificial intelligence has made online professional testing unreliable.

What exactly is ACCA and why its exams are critical

The Association of Chartered Certified Accountants (ACCA) is the world’s largest professional body for accountants, with almost 260,000 fully qualified members and more than 540,000 active students across 181 countries. In the UK, ACCA is one of the three core routes into regulated accounting careers, alongside ICAEW and CIMA.

Holding an ACCA qualification allows accountants to:

- sign off company accounts

- work in audit and compliance

- handle regulated financial reporting

- advise companies on tax and governance

This makes ACCA exams not academic tests but gatekeepers to Britain’s financial system.

What exactly changes and when

The ACCA reform is not a gradual adjustment — it is a hard regulatory switch that will take effect on a fixed date and apply across the entire qualification system.

From 1 March 2026, ACCA will formally end routine remote invigilation for all core professional papers. This means that home-based, webcam-supervised online exams will no longer be the default option for candidates anywhere in the world, including the UK.

Under the new framework:

- Physical attendance becomes the legal standard

Candidates must sit their exams in ACCA-approved exam centres under controlled conditions. These centres operate with identity verification, device control, secure networks and trained invigilators — the same model used by law and medical licensing boards. - Remote exams become an exception, not a right

Online sitting will only be allowed where a candidate can demonstrate a documented inability to attend a centre. ACCA has confirmed that exemptions will be limited to cases such as permanent disability, serious medical conditions, or residence in regions without any accessible testing infrastructure. Each case must be pre-approvedand supported by evidence. - The change applies to the full qualification ladder

This is not limited to final exams. The switch covers:- Applied Knowledge (BT, MA, FA)

- Applied Skills (LW, PM, TX, FR, AA, FM)

- Strategic Professional (SBL, SBR and optional papers)

Until February 2026, candidates can still use the existing remote system. After that date, the online option will effectively disappear for most students. ACCA has confirmed that no transitional grace period will apply once the March deadline passes.

For students, this creates a clear strategic deadline: those who rely on remote sitting have one final exam cycle in 2025–early 2026 to complete as many papers as possible before physical attendance becomes mandatory.

In regulatory terms, this marks a return to what ACCA calls a “controlled assessment environment” — a legal and operational standard that existed before the pandemic and has now been reinstated because of artificial intelligence.em will continue until February 2026, giving candidates one final year to complete papers from home.

Why ACCA says online exams no longer work

ACCA’s decision is not driven by distrust of candidates, but by the collapse of technological control in a world dominated by artificial intelligence. When remote exams were rolled out during the Covid pandemic in 2020, the primary risk was traditional cheating. Most violations involved basic human methods: candidates consulting written notes, receiving help from another person in the room, or secretly using a second phone. These risks, while real, could be reduced through webcams, locked browsers and live human proctors. That balance no longer exists.

Generative AI has fundamentally changed what “cheating” means. Modern systems can now solve professional-level accounting problems in real time, generate technically correct financial statements, apply tax rules, and produce long-form audit and business answers that are indistinguishable from human writing. More importantly, these tools can operate silently and invisibly alongside the exam window — through hidden browser tabs, secondary devices, cloud-based interfaces or even smart glasses.

This creates a regulatory nightmare. Remote invigilation tools were designed to detect human misconduct, not machine assistance. Eye-tracking can tell whether a candidate looks away from the screen, but it cannot see a second device. Screen recording can monitor one browser window, but it cannot detect software running on a parallel system. Keystroke analysis can flag copy-paste behaviour, but it cannot distinguish human typing from AI-generated text that is typed or dictated.

As a result, the exam no longer tests a candidate’s knowledge — it tests their ability to deploy technology without being detected.

A senior compliance adviser who has briefed UK regulators on the issue put it bluntly:

“Once AI is sitting next to the candidate, the exam measures their access to software, not their competence.”

For a professional body like ACCA, whose qualification underpins trust in Britain’s financial system, that shift is unacceptable. An exam that can be bypassed by software is no longer a legal or ethical filter — it becomes a technical vulnerability. That is why ACCA concluded that only a physically controlled environment can now provide defensible exam integrity in the age of artificial intelligence.

Why ACCA could not risk staying online

For ACCA, the issue goes far beyond education. Its qualification is embedded in the legal and financial architecture of the UK economy. Unlike a university degree, an ACCA certificate is relied upon by banks, regulators, auditors, courts and government departments as evidence that an individual is competent, ethically trained and professionally accountable. ACCA members are authorised to prepare statutory accounts, advise on tax compliance, sign off audits and handle regulated financial data. In many cases, their work directly affects share prices, tax revenues and corporate solvency.

That is why ACCA exams function as a regulatory gate, not a classroom test. Employers and authorities assume that an ACCA-qualified accountant has:

- passed a verified and supervised examination process

- demonstrated knowledge of UK financial and company law

- been assessed in a way that can withstand legal scrutiny

- accepted professional and disciplinary liability

If the integrity of that process is weakened, the entire qualification becomes vulnerable. A financial statement signed by an accountant whose exams could have been completed with AI assistance is no longer just an academic issue — it becomes a legal and commercial risk.

This would expose:

- UK stock markets, where audited accounts underpin investor trust

- corporate governance, where directors rely on qualified advisers

- public-sector finance, where billions of pounds are controlled by ACCA-trained professionals

In that context, allowing uncontrolled AI-assisted online exams would be equivalent to lowering the security of the UK’s financial passport system.

ACCA’s leadership therefore concluded that remote testing is no longer defensible in regulatory terms. Only physically supervised exam halls provide the chain of identity verification, device control and behavioural oversight required to protect the credibility of a qualification that sits at the heart of Britain’s financial system.

What this means for UK students in practice

For British candidates, the shift away from remote ACCA exams is not a technical adjustment — it is a structural change to how professional careers are accessed.

From March 2026, most students will be required to sit their papers in physical exam centres under controlled conditions. That means candidates must:

- Book a designated ACCA exam centre, often weeks in advance

- Travel to the location on the exam day, sometimes across regions

- Submit to strict device bans, including the surrender of phones, smartwatches and tablets

- Pass formal identity verification, typically involving photo ID, biometric checks and live invigilator validation

This disproportionately affects certain groups of candidates. Working parents, who previously relied on home-based exams to fit study around childcare, will now have to arrange time off and travel. Remote and hybrid workers will lose the flexibility that made professional retraining viable alongside employment. Students in smaller towns and rural areas may face long journeys to the nearest accredited centre.

ACCA has acknowledged these pressures and confirmed that it will expand UK exam centre capacity in all major financial and university hubs, including:

- London, where demand is expected to be highest

- Manchester, serving the North West and Yorkshire

- Birmingham, covering the Midlands

- Leeds, a growing finance and audit centre

- Bristol, for the South West

- Edinburgh, supporting Scotland’s financial sector

However, ACCA has also warned that exam slots will be limited, especially during peak sitting windows. Candidates who delay booking may face restricted availability, forcing them to postpone papers and extend their qualification timeline.

In effect, ACCA exams are returning to a model where time, location and logistics become part of the qualification process — just as they are for solicitors, doctors and other regulated UK professions.But some candidates will face higher costs and travel time.

Who can still take exams remotely

ACCA has made clear that remote exams will not disappear entirely, but they will be transformed into a strictly regulated accommodation, not a standard option. Under the new policy, only candidates who can demonstrate a legitimate and documented inability to attend a physical exam centre will be permitted to sit ACCA papers online. This includes:

- Candidates with disabilities that make travel, prolonged sitting, or physical attendance impractical or medically unsafe

- Individuals with serious or chronic medical conditions, including those requiring home-based care or immune protection

- Candidates living in regions without accessible ACCA exam centres, where travel would involve extreme distance or hardship

Importantly, these are not automatic entitlements. Each applicant must submit formal evidence, such as medical documentation or geographic verification, and receive prior written approval from ACCA. The remote sitting will then be conducted under enhanced monitoring conditions designed to minimise technological abuse.

This framework mirrors how other regulated professions in the UK already operate. The Solicitors Qualifying Examination (SQE), which governs entry into the legal profession, and medical licensing exams both require physical attendance as the default, with remote or special arrangements granted only as reasonable adjustments under UK equality and regulatory law.

In other words, ACCA is not introducing a new restriction — it is aligning its qualification with the regulatory standards that already apply to Britain’s most trusted professions.

Why this matters beyond accounting

ACCA’s decision goes far beyond the accounting profession. It represents one of the clearest institutional acknowledgements in Britain that artificial intelligence has broken the credibility of remote high-stakes testing.

Until now, most universities and professional bodies have treated AI as a challenge to be managed with software and monitoring. ACCA has taken a different view: that technology has moved faster than enforcement, and that digital exams can no longer deliver the level of legal and reputational certainty required for regulated professions.

This forces a fundamental set of questions across the UK education system:

- Can online exams still certify professional competence?

- Can AI misuse be reliably detected or prevented?

- Can regulators defend digital assessment in court if a qualification is challenged?

By ending routine remote exams, ACCA has effectively answered all three in the negative.

Education policy specialists in Britain now expect a domino effect. Law regulators, financial certification bodies and even some universities are reviewing whether final-year and licensing exams can continue to be offered online without undermining public trust. The legal profession, the financial sector and the NHS all rely on verifiable, defensible qualifications — and those increasingly require physical, supervised environments.

In that sense, ACCA has become the test case for how Britain’s knowledge economy adapts to the age of artificial intelligence. What began as an accounting decision is now reshaping how the UK defines proof of competence in an AI-driven world.

What candidates should do now

If you are studying ACCA in Britain, the strategic implications are clear:

| If you plan to sit exams | Best action |

|---|---|

| Before Feb 2026 | Use remaining remote sessions |

| After March 2026 | Prepare for in-person testing |

| Have mobility issues | Apply early for exemption |

| Live outside cities | Check new test centres |

Students who delay may face booking bottlenecks when physical exams return.

Why ACCA exams just became more valuable

The withdrawal of routine online testing will materially strengthen the standing of the ACCA qualification. From 2026, every newly issued ACCA certificate will be supported by a controlled, in-person assessment regime. Candidate identity will be verified, electronic devices will be restricted, and the use of artificial intelligence will be structurally excluded. That restores what professional credentials are supposed to provide: a defensible proof of competence.

In financial services, qualifications are not symbolic. ACCA members are trusted with statutory accounts, regulatory filings, audit support and tax compliance. These functions carry legal, commercial and fiduciary consequences. If the pathway into the profession is perceived as vulnerable to AI-assisted fraud, that trust erodes — not only in individuals, but in the financial system that relies on them.

By reinstating physical exam halls, ACCA has reinforced the credibility of its gatekeeping role. The qualification will once again be based on verifiable human performance, not on access to software. In a market increasingly saturated with digital credentials of uncertain integrity, that makes ACCA not merely harder to obtain, but more valuable to employers, regulators and investors alike.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Will the UK rejoin Erasmus in 2027 and what does the EU student exchange deal mean for British students