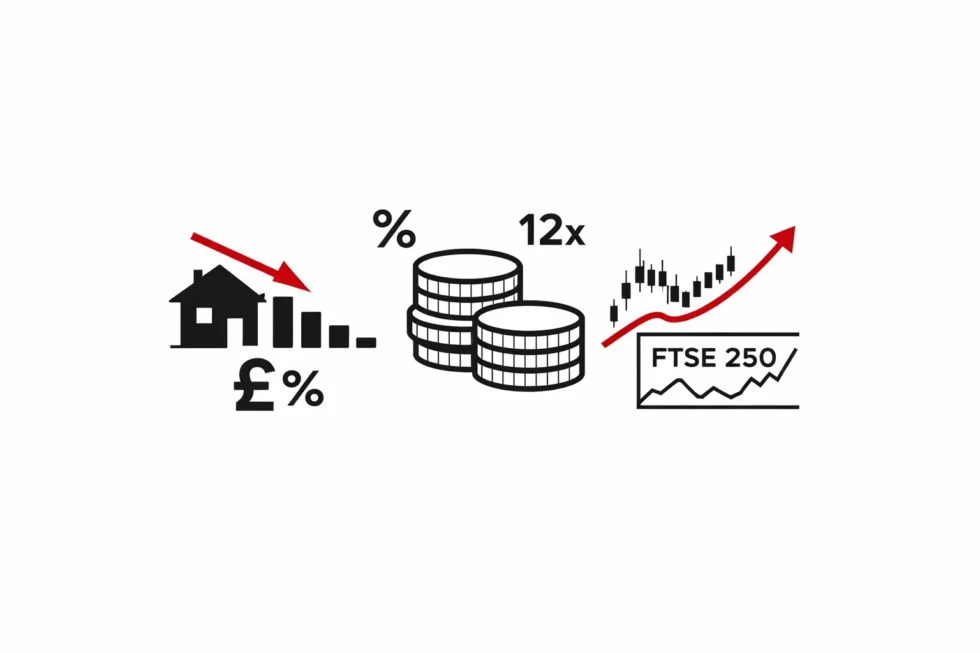

London, 15 January 2026 — Shares in UK housebuilder Taylor Wimpey plc (LSE: TW.) are trading at around 109 pence, up from a near five-year low reached in late 2025, as investors reassess the outlook for Britain’s housing market. At current levels, the stock offers one of the highest dividend yields on the London Stock Exchange at 8.55%, while its price-to-earnings ratio of about 12 places it among the lowest-valued major UK housebuilders.

The rebound comes despite continued weakness in UK property prices. Nationwide reported a 0.4% fall in house prices in December 2025, against expectations of a small rise, marking the slowest annual growth rate since 2024. Falling prices reduce revenue per home for developers such as Taylor Wimpey, while higher labour and material costscontinue to compress margins, making earnings highly sensitive to sales volumes.

The current share price therefore reflects a market caught between deteriorating housing data and expectations of a cyclical stabilisation in 2026. According to The WP Times, citing Nationwide and London financial media, investors are increasingly positioning for a recovery in buyer activity as mortgage rates level off and lower prices bring more first-time buyers back into the market.

What happened to Taylor Wimpey shares in 2025–2026

Taylor Wimpey is one of the UK’s largest residential housebuilders, with developments across England, Scotland and Wales. Its share price declined sharply through 2025 as the British housing market was hit by a prolonged period of high interest rates, weak buyer demand and falling house prices.

Mortgage costs rose to multi-year highs during 2024–2025, sharply reducing affordability for first-time buyers and buy-to-let investors — the two core customer groups for volume housebuilders. As a result, sales reservations slowed across the sector, forcing developers to cut prices, offer incentives and reduce build rates.

According to Nationwide, UK house prices fell by 0.4% in December 2025, when economists had expected a small increase. That data point pushed annual house price growth to its weakest level since 2024, confirming that the housing market had entered a late-cycle slowdown.

For Taylor Wimpey, falling prices directly reduced revenue per home, while construction inflation — particularly in labour, energy and materials — continued to push costs higher. This combination of lower selling prices and rising build costs compressed operating margins across 2025 and drove the company’s share price to its lowest levels since 2020, before a modest recovery in early 2026 lifted the stock back above £1 per share.

Why Taylor Wimpey shares have moved back above £1

The recovery in Taylor Wimpey shares from below 100 pence to around 109p reflects a shift in how investors are pricing the UK housing cycle rather than any sudden improvement in company earnings. By late 2025, UK housebuilder stocks had fallen to levels that implied a prolonged downturn in sales and profits. However, incoming macro-housing data in early 2026 has started to indicate that conditions may be stabilising rather than deteriorating further. Market analysts tracking the sector have pointed to three key signals:

- Mortgage rates have plateaued, easing the pressure on monthly repayments after two years of sharp increases

- House price declines have slowed, suggesting that forced selling and affordability-driven price cuts may be nearing exhaustion

- Buyer enquiries and reservation rates have stopped falling, indicating that demand is no longer contracting at the pace seen in mid-2025

These indicators matter because housebuilders are highly leveraged to changes in volume: even small improvements in sales rates can produce outsized effects on earnings and cash flow. Reflecting this change in outlook, broker research cited in UK financial media has lifted valuation targets, with some analysts now placing 12-month price objectives as high as 172p. From the current level near 109p, that would represent a potential gain of approximately 58%, assuming housing activity stabilises and margins begin to recover.

What a P/E ratio of 12 means for Taylor Wimpey

Taylor Wimpey’s price-to-earnings ratio of around 12 means the market is currently valuing the company at £12 for every £1 of annual profit it generates. For a large, asset-backed UK housebuilder, this places the stock at the lower end of London market valuations. By comparison, the long-term average P/E for the FTSE index is typically around 14–15, while many UK consumer, utility and infrastructure stocks trade on multiples of 18 or higher, reflecting their more stable cash flows.

In the case of Taylor Wimpey, the lower multiple does not reflect balance-sheet stress but rather investor caution about the durability of future earnings. The housing sector is highly cyclical, and when sales volumes and prices weaken, profits can fall rapidly. As a result, the market is applying a discount to reflect uncertainty over how quickly housing demand and margins will recover in 2026, rather than signalling financial distress at the company level.

What is behind Taylor Wimpey’s 8.55% dividend yield

Taylor Wimpey’s 8.55% dividend yield is among the highest in the FTSE 250, primarily reflecting the sharp fall in the company’s share price during 2025, rather than an increase in cash dividends.

Under UK company law, dividends may only be paid from distributable profits. The UK Companies Act 2006 states that companies can only return cash to shareholders from accumulated profits after tax, not from borrowed money or asset values.

Taylor Wimpey’s dividend per share has remained broadly stable over the past year, while its share price declined significantly as UK housebuilder stocks were sold off in response to weakening housing demand. This mathematical effect — a falling share price combined with an unchanged dividend — is what caused the dividend yield to rise.

Dividend yield is calculated as:

annual dividend per share ÷ current share price

UK equity analysts regularly note in sector research that elevated yields in cyclical industries such as housebuilding tend to reflect uncertainty over future earnings rather than improved cash generation. As one London-based equity analyst told the UK financial press, “when housing demand weakens, equity markets typically reprice future profits before dividends are adjusted, which pushes yields temporarily higher.”

Because housebuilders’ profits are driven by sales volumes, selling prices and construction costs, Taylor Wimpey’s ability to maintain its dividend is directly linked to the performance of the UK housing market.

| Metric | Taylor Wimpey |

|---|---|

| Ticker | TW. |

| Exchange | London Stock Exchange |

| Share price (Jan 2026) | ~109p |

| Dividend yield | 8.55% |

| P/E ratio | 12 |

| FTSE index | FTSE 250 |

| Sector | Residential housebuilding |

| Broker high target | 172p |

| Latest house price change | −0.4% (Dec 2025, Nationwide) |

How the UK housing market affects Taylor Wimpey

Taylor Wimpey’s financial performance is directly linked to conditions in the UK housing market, where even small changes in prices and buyer activity can have a disproportionate impact on earnings. According to Nationwide, UK house prices fell 0.4% in December 2025, while transaction volumes across England and Wales remained below pre-2024 levels. At the same time, mortgage rates, although no longer rising, remain high by recent standards, continuing to limit affordability for first-time buyers — the core customer group for volume housebuilders.

For a developer such as Taylor Wimpey, revenue is determined by three variables: how many homes are sold, the average selling price, and the cost of building each unit. When prices fall and sales volumes weaken, income declines, while fixed land and construction costs remain largely unchanged, amplifying the impact on profits. This makes Taylor Wimpey’s earnings and cash flow highly sensitive to changes in the wider UK housing cycle. Taylor Wimpey’s revenue depends on:

- The number of homes sold

- The average selling price

- Construction and labour costs

Falling prices reduce revenue, while higher wages and material costs reduce margins. However, lower prices can also bring new buyers into the market, particularly first-time buyers who were priced out during the 2021–2023 boom. Government data and lender surveys show that buyer activity has stabilised in early 2026, even though prices remain under pressure.

What analysts are monitoring

Equity analysts covering Taylor Wimpey and the wider UK housebuilding sector are tracking a narrow set of indicators that directly affect revenue, margins and cash flow. These include:

- Monthly house price indices published by Nationwide and other lenders, which determine selling prices for completed homes

- Mortgage approval volumes from the Bank of England, which indicate whether buyers can access financing

- Sales reservation rates reported by housebuilders, showing how many new homes are being secured by buyers

- Construction cost inflation, particularly labour and materials, which determines whether margins can recover

Together, these data points establish whether housing activity is stabilising or continuing to contract. In cyclical sectors such as housebuilding, even small changes in volumes can produce large changes in earnings.

Why Taylor Wimpey moved from the FTSE 100 to the FTSE 250

Taylor Wimpey moved from the FTSE 100 to the FTSE 250 after its market capitalisation fell during the housing downturn of 2024–2025. FTSE index membership is determined by company value, not by operating performance. When Taylor Wimpey’s share price declined, its market value dropped below the threshold required to remain among the 100 largest companies listed in London.

Re-entry into the FTSE 100 requires a sustained increase in market capitalisation, which would come from a combination of higher share prices and stable earnings. At current levels near 109p, the company remains outside the top tier of the London market. A move back toward levels seen earlier in the cycle, above 160–170p, would materially change its FTSE ranking.

What the market is pricing in

At around 109 pence, the market is valuing Taylor Wimpey as a cyclical housing stock operating in a weak but not distressed market environment. This is reflected in three observable metrics:

- a P/E ratio of about 12, indicating that investors are discounting future earnings

- a dividend yield of 8.55%, elevated because the share price fell faster than cash payouts

- a large land bank, which underpins long-term asset value even during downturns

Taken together, these indicators show that investors are pricing in a prolonged but manageable housing slowdown, rather than financial instability or balance-sheet risk at the company level.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Why are UK investors questioning Palantir as Nvidia and Google dominate AI stocks in 2026