On Monday, 9 February 2026, Bitcoin stabilised above the $70,000 level in early trading after a sharp bout of volatility at the end of the previous week briefly pushed prices to their lowest point in more than a year. As reported by The WP Times, citing Вloomberg, Bitcoin traded close to the $70,000 mark during Asian market hours, consolidating after a rapid recovery from last week’s sell-off. The move followed a compressed period of intense price swings, underscoring the market’s continued sensitivity to positioning, leverage and liquidity conditions. The latest price action is increasingly being interpreted as a reassessment of market positioning rather than a loss of confidence in Bitcoin’s longer-term trajectory.

Sharp decline followed by rapid recovery

Late last week, Bitcoin briefly slid to $60,033, its lowest level since October 2024, after a period of elevated leverage and heavy speculative positioning across derivatives markets left prices vulnerable to abrupt moves. Once the decline began, stop-loss triggers and forced liquidations accelerated selling pressure, magnifying the downside move.

The pullback, however, proved short-lived. Buying interest emerged near the $60,000 threshold, a level closely monitored by traders as a major technical and psychological support. Within less than 48 hours, Bitcoin recovered the majority of its losses and moved back above $70,000, re-establishing a price range that many market participants regard as a short-term equilibrium zone. Analysts increasingly view this sequence — a rapid liquidation-driven sell-off followed by an equally swift rebound — as a test of market structure and liquidity rather than the beginning of a prolonged downturn, highlighting the market’s capacity to absorb shocks and stabilise after periods of extreme volatility.

Market effects of the correction

Traders and analysts highlight several structural outcomes resulting from last week’s correction:

- Liquidation of speculative positions: The sharp sell-off forced the unwinding of highly leveraged trades, reducing open interest and lowering overall risk across futures and options markets.

- Confirmation of $60,000 as a key support level: The market’s ability to rebound decisively from this area reinforced its status as a major psychological and technical floor.

- Evidence of underlying demand: The speed and scale of the recovery suggested the presence of deferred buying interest from longer-term investors and institutions.

Together, these factors contributed to what several desks describe as a healthier market setup heading into the current week.

Traders remain cautious despite stabilisation

Despite the recent rebound, market sentiment remains cautious, with participants refraining from aggressive risk-taking amid lingering uncertainty over the durability of the recovery.

“Crypto markets have stabilised, but there is still uncertainty over whether the worst is fully behind us,” said Caroline Moran, co-founder of Orbit Markets, highlighting that recent price action has reduced immediate stress without fully resolving downside risks. She added that while the policy environment in the United States has become more supportive of digital assets and institutional participation continues to expand, Bitcoin remains susceptible to abrupt price swings. According to Moran, the asset has yet to consistently demonstrate hedge-like behaviour during periods of heightened geopolitical or macroeconomic stress, limiting its role as a defensive allocation in risk-off conditions.

ETF inflows signal renewed institutional activity

Signs of renewed institutional interest emerged towards the end of last week. On 6 February, US-listed spot Bitcoin exchange-traded funds recorded net inflows of $221 million, according to market data cited by Bloomberg.

The inflows followed several consecutive sessions of selling pressure and are widely interpreted as an indication that larger investors viewed prices near the $60,000 level as an attractive entry point rather than a signal of a broader deterioration in market conditions. Market participants note that such behaviour is consistent with longer-term allocation strategies rather than short-term speculative positioning. Sean McNulty of FalconX described the current market tone as “cautiously constructive”, saying that recent volatility had helped clear excessive leverage and speculative positioning from the market.

“We are seeing a transition away from short-term speculative trading towards accumulation based on stronger fundamentals,” McNulty said.

Technical outlook: key levels in focus

Analysts at Orbit Markets and IG Australia outline a clearly defined technical framework for the near term, with several levels attracting heightened attention.

Critical resistance zone: $73,000–$75,000

A sustained daily close above $75,000 is widely viewed as the final major technical barrier. A breakout above this range could trigger renewed momentum-driven buying and shift short-term market dynamics.

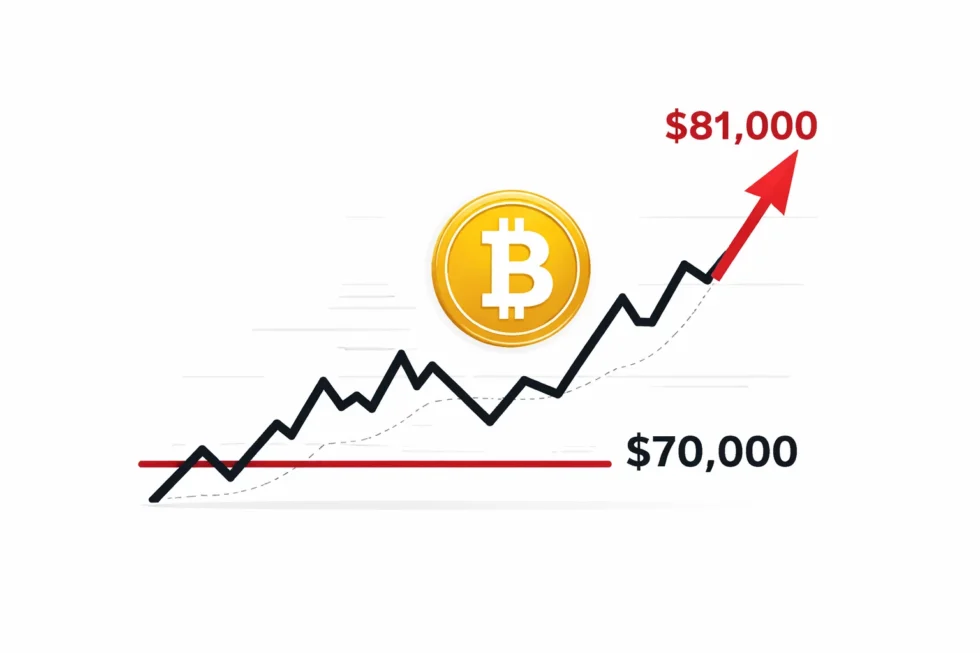

Upside scenario: $81,000

If inflows into spot Bitcoin ETFs remain steady and broader risk sentiment holds, analysts suggest that the $81,000 level could be tested in the near term, potentially before the end of the current week.

Primary risk threshold

As long as Bitcoin remains above its 200-week moving average, currently around $58,000, most technical models do not classify the market as being in a renewed bearish phase, keeping downside risk assessments contained.

Political backdrop and longer-term narrative

The broader policy environment continues to influence investor expectations around digital assets. US President Donald Trump has previously stated his intention to position the United States as a global hub for Bitcoin and digital assets, a stance that market participants view as contributing to a more supportive long-term policy narrative for the sector.

Past price milestones also remain part of the market’s reference framework. In May 2025, Bitcoin briefly moved above the $100,000 level for the first time in several months, rising more than 3% in a single session. The move reinforced perceptions of sustained institutional participation during periods of favourable liquidity and risk conditions, even as volatility remained elevated.

Market focus in the days ahead

Last week’s turbulence did more than test Bitcoin’s short-term resilience. It prompted a reassessment of market positioning, reduced speculative excess and reset near-term risk dynamics. The coming days are expected to clarify whether Bitcoin can decisively break through key resistance levels and extend gains, or whether it will enter a phase of consolidation as the market digests recent moves. For now, attention remains centred on price behaviour around the $75,000 level, which traders widely regard as the critical threshold for determining short-term directional momentum.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Gold and silver prices today UK: market signals on 2 February 2026