January 2026 has become one of the most financially sensitive months the UK has faced since the pandemic, as high energy bills, rising food prices and record housing costs collide with benefit and pension payments for more than 24 million people across cities including London, Manchester, Birmingham and Glasgow.

Although inflation has eased from its cost-of-living peak, household budgets remain under intense pressure, with energy bills still around 40% higher than before the crisis, food prices about 25% above pre-pandemic levels and housing costs absorbing up to half of net income in parts of southern England, The WP Times reports, citing the UK Department for Work and Pensions (DWP), Ofgem and the Joseph Rowntree Foundation.

More than one in three UK residents now relies on support from the Department for Work and Pensions — including Universal Credit, disability benefits and the state pension — making the timing and size of January payments critical for covering rent, heating and food during the coldest weeks of the year.

At the same time, around £24bn in benefits goes unclaimed annually, even as household debt linked to energy and rent continues to rise, increasing the risk of arrears and financial distress across England, Scotland and Wales.

Why financial pressure on UK households is still rising

Despite inflation falling to just over 3% at the end of 2025, the cost-of-living crisis has not ended for UK households. Prices have not fallen — they are simply rising more slowly, leaving millions still paying far more for essentials than before the shock of 2022–2023. The Joseph Rowntree Foundation says low-income families are experiencing the sharpest sustained fall in living standards since records began, driven by energy, housing and food costs that continue to outpace income growth.

The strain is now visible across every major household budget line. The Trussell Trust estimates that around 14 million adults in the UK have struggled to afford enough food in the past year, with food bank use rising sharply in cities including London, Manchester, Birmingham and Glasgow. At the same time, Ofgem reports that household energy debt has climbed above £4.4bn, more than double pre-crisis levels, as millions of customers fall behind on gas and electricity bills during successive winters of high prices.

Housing costs are compounding the pressure. Private rents and mortgage payments remain close to record highs, particularly in southern England and major urban centres, where housing can absorb 35–50% of net household income. For families already stretched by food and energy costs, this leaves little financial buffer when bills arrive.

For the one in three UK residents who depend on benefits or the state pension, the risk is greatest. Even small delays, deductions or shortfalls in January payments can quickly trigger rent arrears, heating rationing or emergency borrowing, pushing vulnerable households deeper into debt at the coldest and most expensive time of the year.

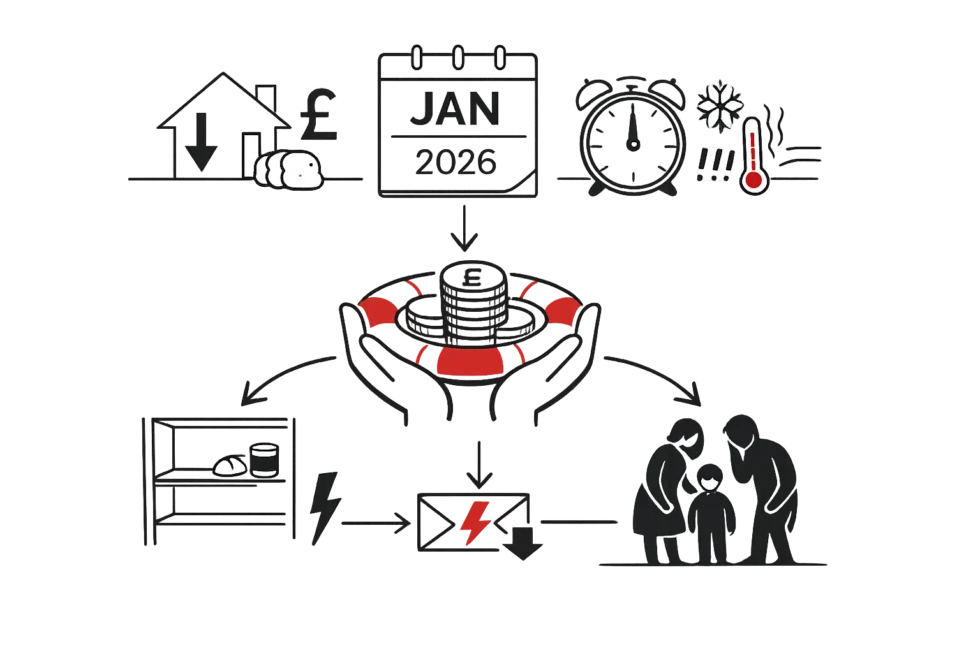

The January 2026 solution: how the UK payment system works

The UK government has confirmed that all benefits and state pension payments will continue on their normal schedule in January 2026, with one critical adjustment for the New Year bank holiday. Anyone whose payment date falls on Wednesday 1 January 2026 will be paid early, on Tuesday 31 December 2025. This applies to all major forms of state support, including:

- Universal Credit

- State Pension and Pension Credit

- PIP, DLA and Attendance Allowance

- Carer’s Allowance

- ESA, Jobseeker’s Allowance and Income Support

The early-payment rule is designed to prevent households from being left without money during the long holiday closure of banks and government offices — a period when rent, food and energy costs still fall due. For millions of low-income families and pensioners, this single calendar shift determines whether January begins with stability or immediate financial stress.

State pension: exactly when the money arrives

The UK state pension is paid every four weeks, and the payment day depends on the last two digits of a person’s National Insurance (NI) number.

| NI number ends in | Paid on |

|---|---|

| 00–19 | Monday |

| 20–39 | Tuesday |

| 40–59 | Wednesday |

| 60–79 | Thursday |

| 80–99 | Friday |

If a scheduled payment date falls on a bank holiday, the pension is paid early, usually on the last working day before the holiday. In January 2026, that means some pensioners will receive their income before the New Year, but must then stretch it across a longer gap before the next payment.

April 2026 uprating: what will change after winter

While January 2026 payments are made at current benefit and pension rates, the financial landscape for millions of UK households will shift in April 2026, when annual uprating takes effect. These changes will determine whether families recover from the winter squeeze or remain trapped by high energy bills, housing costs and debt, as new rates for Universal Credit, disability benefits and the state pension reset household incomes for the year ahead.

Universal Credit

The standard allowance is set to rise by about 6.2%, slightly above inflation.

| Household | Weekly now | From April 2026 |

|---|---|---|

| Single (25+) | £92 | £98 |

| Couple (25+) | £145 | £154 |

The increase is intended to offset food and energy costs, but for many families it will be absorbed by higher rents, utilities and debt repayments.

Disability and carer benefits

Payments for PIP, DLA, Attendance Allowance, ESA and Carer’s Allowance will rise by 3.8%, in line with inflation. However, a major structural change hits people who are newly sick or disabled on Universal Credit. The health element will be cut from £105 to £50 per month, and then frozen until 2029. In real terms, that represents a loss of more than £200 a month for future claimants compared with previous rules.

State pension

The full new state pension will rise by 4.8%, increasing to £241.05 per week. This reflects earnings growth under the triple lock, but still leaves many pensioners exposed to high energy and housing costs during winter.

Extra winter support available in January 2026

January is the peak month for cold-weather financial support, as freezing temperatures, higher heating demand and rising energy bills activate emergency schemes designed to protect low-income and vulnerable households. During this period, temporary winter payments and price protections become most critical, particularly in parts of Scotland, northern England, the Midlands and rural Wales, where prolonged cold spells are most likely to push families into fuel poverty.

Cold Weather Payments

Households on certain benefits receive £25 for each seven-day period when temperatures in their postcode area stay at or below 0°C.

This winter, more than one million households across around 800 postcode areas are expected to qualify, particularly in Scotland, northern England, the Midlands and rural Wales.

Energy bills

Ofgem has set the January–March 2026 energy price cap at £1,758 for a typical household. While only slightly higher than the previous quarter, it comes at a time when energy debt already exceeds £4.4bn, leaving millions paying off arrears on top of their monthly bills.

What households can do right now

With January 2026 bringing some of the tightest cashflow conditions since the pandemic — as energy bills peak, rents fall due and benefit payments are stretched across longer gaps — households face an increased risk of arrears, overdrafts and emergency borrowing. Financial and welfare experts say that early action in the first weeks of January can make the difference between stability and crisis, particularly for families and pensioners who rely on state support. Three steps are now considered critical for protecting household finances through the winter.

Check benefit entitlement

Millions of people qualify for support without realising it. A full benefits check can reveal eligibility for:

- Universal Credit

- Pension Credit

- Disability benefits

- Housing support

Apply for local help

Local councils distribute money from the Household Support Fund, which runs until March 2026 and can provide:

- Cash grants

- Energy vouchers

- Essential household appliances

Cut fixed bills

Households on benefits may qualify for:

- Social broadband tariffs

- Water bill discounts

- Council tax reductions

With more than 24 million people reliant on state support and household debt still rising, January 2026 is a stress test for the UK welfare system. While April’s uprating offers limited relief, the cuts to disability elements and the absence of new cost-of-living payments mean millions remain financially exposed through the winter — making the timing and reliability of January payments a matter of national economic stability.

Read about the life of Westminster and Pimlico district, London and the world. 24/7 news with fresh and useful updates on culture, business, technology and city life: Millions in the UK leaving thousands unclaimed as cash sits idle in 0% accounts

Primary sources: UK Department for Work and Pensions, Ofgem, Joseph Rowntree Foundation, Trussell Trust